ROI and KPIs in AI Process Optimization

NWA AI Team

Editor

ROI and KPIs in AI Process Optimization

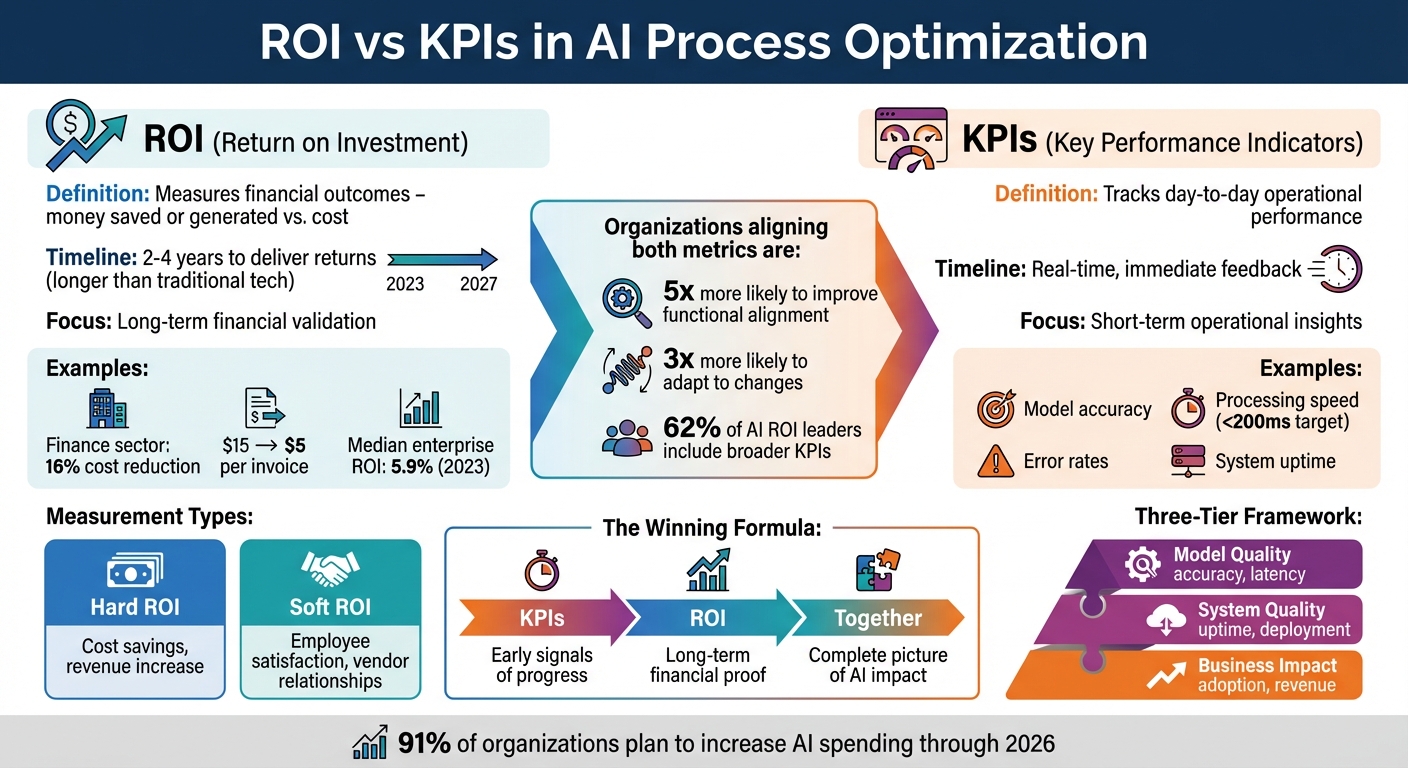

When you invest in AI, how do you prove it’s working? Two metrics are key: ROI (Return on Investment) and KPIs (Key Performance Indicators). ROI measures financial outcomes - how much money AI saves or generates compared to its cost. KPIs, on the other hand, track day-to-day performance, like accuracy, speed, and error rates. Together, they provide a full picture of AI’s impact.

Here’s why they matter: AI often takes 2–4 years to deliver ROI, much longer than other tech. KPIs act as early signals, showing progress before financial results kick in. For example, tracking KPIs like processing speed or accuracy can prove your AI system is improving operations, even if ROI hasn’t materialized yet.

Organizations that align KPIs with ROI goals are 5x more likely to improve functional alignment and 3x more likely to adapt to changes. The key is using both metrics strategically - KPIs for short-term insights and ROI for long-term validation. This balance ensures AI investments deliver measurable results, both financially and operationally.

Want to improve your AI strategy? Start by setting clear baselines, track both "hard ROI" (e.g., cost savings) and "soft ROI" (e.g., employee satisfaction), and use KPIs to monitor real-time performance. The longer-term benefits will follow.

ROI vs KPIs in AI Process Optimization: Key Differences and Strategic Balance

Measuring AI Success: Beyond Technical Metrics

What ROI and KPIs Mean for AI Optimization

ROI (Return on Investment) is all about measuring the financial payoff of your AI investments. It shows whether your AI initiatives are helping you make more money, save costs, or both. For example, companies in the finance sector that have fully embraced AI have managed to cut their annual finance function costs by 16% as a percentage of revenue. Another example? Automating accounts payable can slash the cost of processing a single invoice from $15 (manual) to $5 or less.

On the other hand, KPIs (Key Performance Indicators) focus on how well your AI systems are performing operationally. These metrics track things like model accuracy, prediction speed (usually aiming for under 200ms), deployment timelines, error rates, and system uptime. Think of KPIs as real-time health checks - they tell you if your AI systems are running smoothly and delivering as expected.

While ROI tends to provide a long-term view of financial results, KPIs offer immediate feedback on operational performance. Take this example: a Fortune 500 manufacturing company used Tableau Pulse to monitor supply chain KPIs. The AI system flagged a revenue dip in Europe two weeks ahead of a scheduled review, giving the CFO time to act and saving the company an estimated $4 million.

When used together, ROI and KPIs give you a complete picture - validating both the financial impact and the day-to-day effectiveness of your AI efforts. Fiona Tan, CTO at Wayfair, captures this balance well:

"AI agents can be applied to so many use cases, the number of businesses adopting them should be 100%. I can quickly point to dollars saved".

But here’s the thing: ROI models don’t always capture the less tangible benefits of AI, like happier employees or stronger relationships with vendors. That’s why 62% of companies leading in AI ROI include a broader range of KPIs in their strategies. This approach helps them stay committed to AI investments, even during periods when the financial returns aren’t fully realized yet. Balancing these metrics is key as AI initiatives continue to grow and evolve.

1. ROI in AI Process Optimization

Measurement Focus

Tracking ROI in AI isn't as simple as evaluating traditional software investments. It involves two main types: Hard ROI and Soft ROI. Hard ROI represents measurable financial benefits like reduced labor costs, faster processing times, and fewer errors. Meanwhile, Soft ROI focuses on less tangible outcomes, such as improved employee satisfaction, better vendor relationships, and enhanced decision-making capabilities.

Before deploying AI, it's essential to establish a baseline. This means documenting current metrics like processing times, error rates, and costs to assess the actual impact AI has later. For instance, PayPal's use of transformer-based deep learning for fraud detection nearly halved its losses. Even with annual payment volumes doubling to $1.36 trillion between 2019 and 2022, they achieved an 11% reduction in fraud-related losses.

Another critical factor is understanding the Total Cost of Ownership (TCO). This extends beyond development costs to include operational expenses like data labeling, prompt engineering, monitoring, and human oversight. Michael Mansard from Zuora's Subscribed Institute explains:

"Traditional SaaS is expensive to build but has near-zero marginal costs, while AI is inexpensive to develop but incurs high, variable operational costs".

These metrics directly influence how organizations decide where to invest in AI.

Impact on Decision-Making

ROI calculations play a major role in shaping AI investment strategies. The numbers reveal that enterprise-wide AI projects delivered a median ROI of just 5.9% in 2023. On average, AI investments take 2 to 4 years to yield returns. This underscores the importance of having solid baseline measurements in place before launching AI initiatives.

Even with these extended timelines, organizations remain committed to AI. In 2025, 85% of businesses increased their AI spending, and 91% planned further increases for 2026. A key factor driving this is the Risk of Non-Investment (RONI) - evaluating the financial and opportunity costs of not adopting AI. A striking example is SA Power Networks, whose AI-powered system achieved a 99% success rate in identifying poles at risk of corrosion, saving the company $1 million in just one year.

Integration into AI Strategies

Top-performing organizations follow the "10-20-70" principle: 10% of effort goes into algorithms, 20% into data and technology, and 70% into people, processes, and organizational transformation. This approach emphasizes more than just acquiring tools - it focuses on reshaping how the organization operates.

Success also comes from prioritizing depth over breadth. Companies leading in AI ROI focus on an average of 3.5 high-impact use cases rather than spreading resources thinly across 6.1 projects. They dedicate over 80% of AI investments to transforming major functions and developing new offerings, rather than minor productivity improvements. Nestlé exemplifies this strategy: by integrating AI-driven tools into SAP Concur, they automated expense management, eliminating manual tasks entirely and tripling employee efficiency in report creation.

Continuous ROI analysis is vital. Machine learning models can degrade over time due to model drift, so ongoing monitoring is necessary. Given the 2-4 year timeline for AI ROI, real-time tracking tied to initial baselines ensures sustained benefits. To improve accuracy in blended human-AI processes, organizations are adopting tagging frameworks to label workflow stages as "machine-generated", "human-verified", or "human-enhanced".

For those looking to refine their AI strategies, resources like the Northwest Arkansas AI Innovation Hub (https://nwaai.org) provide practical guidance on implementing AI solutions without requiring extensive coding expertise.

sbb-itb-e5dd83f

2. KPIs in AI Process Optimization

Measurement Focus

When it comes to AI optimization, KPIs (Key Performance Indicators) are typically examined across three main tiers: Model Quality, System Quality, and Business Impact.

- Model Quality emphasizes technical performance, tracking metrics like error rates, latency, and "groundedness" - essentially, the AI's ability to stick to the information it's been provided.

- System Quality focuses on the health of the infrastructure, monitoring factors like deployment speed, uptime, and GPU usage.

- Business Impact measures the direct outcomes, such as improved call containment rates in customer service or increased revenue per visit in retail settings.

This structured approach lays the groundwork for metrics that go beyond just tracking performance - they provide actionable insights.

A shift toward "Smart KPIs" is redefining how performance is measured. These advanced metrics move from simple scores to becoming descriptive, predictive, and even prescriptive tools. A great example of this is Wayfair. In February 2024, CTO Fiona Tan revisited their "lost-sales" KPI. AI analysis revealed that 50%–60% of these "lost" sales were actually redirected to alternative purchases within the same category. By reworking this into a "category-based retention" KPI, Wayfair enhanced its recommendation engine and logistics, resulting in better alignment with customer behavior.

Impact on Decision-Making

Smart KPIs are game-changers for decision-making. They uncover interdependencies that might otherwise go unnoticed, enabling organizations to adapt more effectively to changing market conditions. Instead of sticking to traditional benchmarks, these AI-driven metrics provide a deeper, more dynamic understanding of performance.

Take Tokopedia, for instance. The Indonesian e-commerce giant introduced an AI-powered "merchant quality" scoring system. This tool analyzes millions of data points on merchant behavior and fulfillment, connecting customers with the most reliable sellers. According to CTO Herman Widjaja, this system has directly boosted transaction volumes by improving buyer trust.

Sanofi offers another compelling example. The pharmaceutical company uses an AI app called "Plai" to provide real-time KPI data to 10,000 executives. Stephanie Androski, Head of Global Finance Operations, noted that the tool predicts out-of-stock situations four months in advance, allowing teams to adjust forecasts and strategies proactively. This kind of foresight not only strengthens supply chain management but also enhances market share strategies. It’s no wonder that 70% of executives consider improved KPIs essential for success.

Integration into AI Strategies

As KPIs evolve to become more predictive and prescriptive, having strong governance in place is critical. Organizations need formal mechanisms to ensure these metrics remain aligned with business goals and don’t devolve into "vanity metrics". Hervé Coureil, Chief Governance Officer at Schneider Electric, highlights this point:

"We want our KPIs to evolve over time because we don't want to drive our business on legacy or vanity metrics".

Before implementing AI, it's essential to gather 8–12 weeks of baseline performance data. Research shows that companies revising their KPIs with AI are three times more likely to achieve stronger financial outcomes compared to those that don’t. However, only 34% of managers currently leverage AI to create new KPIs, even though 60% admit their current metrics need updating. Bridging this gap requires improving AI literacy across organizations, a goal supported by resources like NWA AI (https://nwaai.org).

Pros and Cons

When it comes to AI optimization, ROI-focused and KPI-focused approaches each bring their own set of advantages and challenges. Understanding how these strategies complement or clash with one another is key to evaluating their role in driving success.

ROI-driven strategies are excellent for justifying investments and focusing on high-value opportunities that align with broader corporate goals. This approach often helps secure leadership support by tying AI initiatives directly to business priorities. But there's a catch: AI investments tend to follow a "J-curve" trajectory. Early on, costs are steep, and benefits are modest, which can make short-term ROI calculations misleading. For instance, enterprise-wide AI efforts have shown a median ROI of just 5.9%, despite requiring a 10% capital investment. To complicate matters further, AI rarely works in isolation - it’s often rolled out alongside efforts like improving data quality or restructuring teams, making it tough to pinpoint its standalone value.

KPI-focused strategies, on the other hand, shine in providing real-time insights into system performance. Metrics like accuracy, latency, and adoption rates offer actionable feedback for fine-tuning models and ensuring operational efficiency. Companies that prioritize KPIs are reportedly five times more likely to enhance cross-functional collaboration and three times more agile in their workflows. However, there's a downside: if these metrics aren’t linked to financial outcomes, they risk creating "pilot purgatory" - a state where technical experiments fail to deliver any meaningful business impact. As Marina Danilevsky from IBM aptly put it:

"People said, 'Step one: we're going to use LLMs. Step two: What should we use them for?'"

| Approach | Primary Strengths | Primary Weaknesses |

|---|---|---|

| Focus on ROI | Secures leadership support, targets high-value use cases, and aligns with corporate strategy | Misleading in early stages due to high initial costs, difficult to quantify intangible benefits, and may overlook ethical concerns |

| Focus on KPIs | Delivers real-time technical insights, supports precise model adjustments, and tracks system health | Risks reliance on vanity metrics that don’t drive profit and may lead to isolated technical experiments |

The takeaway? A balanced approach that integrates both ROI and KPIs is essential. While KPIs act as early indicators of operational success, ROI offers a clearer picture of long-term financial impact. This balance is critical, especially since about 95% of AI investments yield limited measurable returns. To make the most of both strategies, organizations should establish baselines early, use KPIs to monitor technical performance, and assess both "hard ROI" (e.g., cost savings) and "soft ROI" (e.g., employee morale and customer satisfaction) for a more complete view.

Conclusion

Striking the right balance between ROI and KPIs is key to capturing both the technical performance and the financial impact of AI initiatives. KPIs offer real-time insights into technical performance, helping fine-tune models and monitor system health. Meanwhile, ROI connects these technical advancements to the financial outcomes that matter most to stakeholders.

As highlighted earlier, the most effective organizations use a three-layered framework to measure success: model quality (like accuracy and latency), system quality (such as infrastructure robustness and data relevance), and business impact (including adoption rates and bottom-line results). This approach ensures technical achievements translate into meaningful financial gains, avoiding the trap of celebrating improvements that don’t drive profit.

Aligning AI efforts with business goals is non-negotiable. AI alone doesn’t create value; it only matters when it directly supports business objectives. Start with clear goals, not the tools. Define what success looks like before selecting the technology. Research shows that organizations explicitly including AI in their corporate strategy are 62% more likely to rank among top performers.

It’s also important to keep the "J-curve" in mind. AI investments often take 2–4 years to deliver returns, a longer timeline compared to the 7–12 months typically seen with traditional technologies. Using metrics like Net Present Value (NPV) can help model ROI over several years. To capture the full strategic value, balance "Hard ROI" (measurable cost savings) with "Soft ROI" (like improved employee morale and customer satisfaction). And don’t forget: any time saved through automation or efficiency gains should be reinvested into high-value activities.

To make AI adoption truly successful, build continuous feedback loops with cross-functional teams - bringing together finance, IT, and business operations. This ensures KPIs remain aligned with both financial goals and broader corporate strategies. For organizations in Northwest Arkansas, resources like the NWA AI - Northwest Arkansas AI Innovation Hub (https://nwaai.org) offer targeted training to accelerate AI adoption. With 91% of organizations planning to boost AI spending through 2026, those who master the balance between ROI and KPIs will be best positioned to see measurable returns. This integrated approach guarantees that every AI initiative contributes directly to achieving strategic business goals.

FAQs

How can businesses align AI project KPIs with ROI objectives effectively?

To ensure that KPIs align with ROI in AI projects, businesses need to prioritize metrics that can be quantified and directly show financial and operational outcomes. Examples include metrics like cost reductions, revenue increases, improvements in process efficiency, and rates of user adoption. The key is to make sure each KPI is clearly linked to specific aspects of ROI, creating a direct line between performance and the value delivered.

Keep a close eye on the results of your AI initiatives by regularly monitoring factors such as model accuracy, processing speed, and overall business performance. Be prepared to tweak your strategies to stay on track with your ROI objectives and fully capitalize on the advantages AI can bring to your operations.

What are some examples of non-financial benefits (soft ROI) from AI investments?

Soft ROI encompasses the non-financial perks businesses reap from investing in AI. For instance, AI can lead to happier employees by simplifying workflows, quicker decisions through actionable insights, a boosted brand image thanks to adopting cutting-edge methods, and greater potential for innovation as AI opens doors to new possibilities. While these benefits might not show up directly on a financial statement, they can play a pivotal role in driving long-term growth and success.

Why is it crucial to set benchmarks before implementing AI solutions?

Setting benchmarks is crucial because they give you a clear baseline to evaluate the effects of AI-driven initiatives. Without these reference points, it’s tough to measure ROI or monitor improvements in key performance indicators (KPIs) effectively.

When you compare AI-powered results to your original benchmarks, it becomes easier to quantify performance improvements and ensure they align with your business objectives. Plus, this process highlights areas that might need fine-tuning, helping you get the most out of your AI investments.

Ready to Transform Your Business with AI?

Join our AI training programs and help Northwest Arkansas lead in the AI revolution.

Get Started TodayRelated Articles

How Blended Learning Improves AI Upskilling

Blended learning—online modules plus hands-on workshops—boosts AI skill retention, engagement, and real-world application for faster workplace upskilling.

5 Steps to Define AI Workflow Goals

Set measurable AI workflow goals in five steps: map processes, set SMART targets, pinpoint AI opportunities, define KPIs, and align with strategy.

Free AI Courses for Small Business Owners

Free, beginner-friendly AI courses and local workshops help small businesses automate tasks, improve marketing, and adopt AI securely without coding.